Documents that originate outside the company are considered more reliable than those. Audit evidence from external sources for example confirmation received from a third party is more.

Audit Evidence Meaning Example Top 6 Types Of Audit Evidence

C The cost of obtaining evidence is not an important.

. Which of the following statements concerning audit evidence is correct. Which of the following statements is correct concerning an auditors assessment of control risk. B is corrent because appropriate evidence is both relevant and reliable.

A To be reliable evidence should be convincing rather than simply persuasive. Audit evidence obtained from an independent external source is always reliable D. The cost of obtaining evidence is not an important consideration to an auditor in.

A clients accounting records can be sufficient audit evidence to support the financial statements. A Evidence obtained from an independent source outside the client organization is more reliable than that obtained from within. Which of the following statements concerning audit evidence is correct.

Which of the following statements concerning audit evidence is correct. To be appropriate audit evidence should be either persuasive or relevant but need not be bothb. Effective internal controls contribute little to the reliability of the evidence created within the entity.

A Appropriate evidence supporting managements assertions should be convincing rather than persuasive. A given set of procedures may provide audit evidence that is relevant to certain assertions but not others C. D is incorrect because while auditors must attempt to perform.

Multiple Choice Appropriate evidence supporting managements assertions should be convincing rather than persuasive. An audit usually involves the authentication of documentation B. The cost of obtaining evidence is not an important.

Wrong - Your answer is wrong. Correct - Your answer is correct. Accounting questions and answers.

The measure of the reliability of audit evidence lies in the auditors judgment. To be competent audit evidence should be either persuasive or relevant but need not be both. Effective internal control contributes little to the reliability of the evidence created within the entity.

Which of the following statements is nota correct statement regarding audit evidence. Responses a b and c are not. D A clients accounting data cannot be considered.

Which of the following statements concerning audit evidence is correcta. Solutions for Chapter 5 Problem 19MCQ. Which of the following statements concerning audit evidence is correct.

The difficulty and expense of obtaining audit evidence concerning an account balance is a valid basis for omitting the test. Sufficiency is the measure of the quality of audit evidence that is its relevance and reliability. Sufficiency is the measure of the quality of audit evidence that is relevance and reliability c.

Which of the following presumptions is correct regarding the reliability of audit evidence. Appropriateness is the measure of the quantity of audit evidence. A small sample of only one or two pieces of highly appropriate evidence is always considered persuasive evidence.

Sufficiency is the measure of the quality of audit evidence that is its relevance and reliability. C is incorrect because reliable evidence may not be sufficient evidence. B Information obtained directly from outside sources is considered to be the most reliable type of evidence.

The difficulty and expense of obtaining audit evidence concerning an account balance is a valid basis for omitting the test. External evidence such as communications from banks is generally regarded as more reliable than answers obtained from inquiries of the client b. Which of the following statements concerning audit evidence is correct.

The difficulty and expense of obtaining audit evidence concerning an account. Which of the following statements concerning audit evidence is correct. Appropriate evidence supporting managements assertions should be convincing rather than merely persuasive.

Which of the following is a correct statement regarding audit evidence. Which of the following is a correct statement regarding audit evidence. A companys accounting data cannot be considered sufficient audit evidence to support the financial statements.

Audit evidence to support the financial statements. Appropriateness is the measure of the quality of audit evidence. The quantity of audit evidence needed is affected by its quality and the risk of misstatement.

The quantity of audit evidence needed is affected by its quality and the risk of misstatement. Which of the following statements concerning audit evidence is correct. Assessing control risk may be performed concurrently during an audit with obtaining an understanding of the entitys internal control.

A small sample of only one or two pieces of highly appropriate evidence is always considered persuasive evidence. B Effective internal controls contribute little to the reliability of the evidence created within the entity. Which of the following statements is not a correct statement regarding audit evidence.

Which of the following statements concerning audit evidence is correct. Which of the following statements concerning audit evidence is correct. B Documentary evidence is more reliable when it is received by the auditor indirectly rather than directly.

A is incorrect because by itself accounting data cannot be considered sufficient support of the financial statementscorroborating audit evidence is necessary. The measure of the reliability of audit evidence lies in the auditors judgmentc. A large sample of evidence provided by an independent party is always considered persuasive evidence.

Which set of assertions is tested when during completion of the audit the audit partner conducts a final review of the format of the entitys balance sheet. The measure of the validity of audit evidence lies in the. A large sample of evidence provided by an independent party is always considered persuasive evidence.

The quantity of audit evidence needed is affected by its quality and the risk of misstatement d. Appropriateness is the measure of the quantity of audit evidence b. To be appropriate audit evidence should be either reliable or relevant but it need not be both.

The difficulty and expense of obtaining audit evidence concerning an account balance is. To be appropriate audit evidence should be either persuasive or relevant but need not be both. The measure of the validity of audit evidence lies in the auditor s judgment.

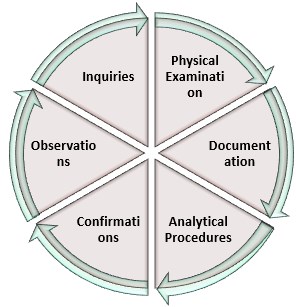

Audit Procedures Types Assertions Accountinguide

Audit Evidence Meaning Example Top 6 Types Of Audit Evidence

Acc 305 Final Exam Part 1 Exam Final Exams Financial Statements

Auditing And Accounting During And After The Covid 19 Crisis The Cpa Journal

0 Comments